Both long and short option holders should be aware of the effects of Theta on an

option premium. Theta is represented in an actual dollar or premium amount and may

be calculated on a daily or weekly basis. Theta represents, in theory, how much

an option's premium may decay per day/week with all other things remaining the same.

Theta or time decay is not linear. The theoretical rate of decay will tend to increase

as expiration approaches. Thus, the amount of decay indicated by Theta tends to

be gradual at first and accelerates as expiration approaches. Upon expiration, an

option has no time value and trades only for intrinsic value, if any. Pricing models

take into account weekends, so options tend to decay seven days over the course

of five trading days. However, there is no industry-wide method for decaying options

so different models show the impact of time decay differently. If a pricing model

is decaying options too quickly, current markets may look too high when compared

to the model's theoretical values, and if the model is displaying the decay too

slowly, the current markets may look too cheap compared to the model's theoretical

values.

If XYZ were trading at $50 and 50 strike call was trading at $3 with a Theta of

.05, an investor would anticipate that option to lose about $0.5 per day, all things

remaining the same. If a day passed without a change in the option price, then one

of the other variables must have changed. In most cases, it must have been an increase

in implied volatility. If the option decreased more than $.05 an investor might

deduce that implied volatility on that strike or product might have dropped as well.

And as expiration approaches, it is likely Theta would become increasingly negative.

At the end of the second trading day, with one day left until expiration, the Theta

should equal the entire amount of time value left in the option.

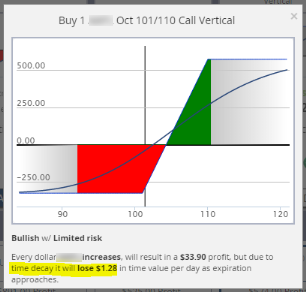

The picture below shows how you can incorporate Theta into your analysis: