Knowing how to invest money is not always enough, finding the best investments and

opening the correct brokerage account(s) is a necessity for good wealth management.

Investing money is just the start; you also need to be able to find the right investment

opportunities (whether you prefer stocks, options, or publicly listed investment

companies such as ETFs) to make good investments.

Stock Trading

You can trade stocks listed on all major exchanges with SogoTrade..

Trade stocks listed on NASDAQ, AMEX and NYSE.

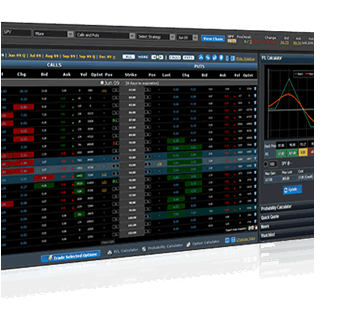

Options Trading

Option trading provides many advantages over other investment vehicles; Leverage,

limited risk, insurance and profiting in bull or bear markets.

Sogotrade is also pleased to announce that trading in Weekly options is now available

on the Sogotrade Options platform. Find out for yourself why so many traders love

trading weekly options.

Try our basic or advanced trading platforms that offer our intuitive options trading

tools.

ETFs

Diversify your trading portfolio with ETFs trading product . You can utilize our

low cost trading commission to trade different type of assets, commodities or sectors

ETFs.

IRA Accounts

Traditional IRA.

You can establish and make contributions to an IRA if you received taxable compensation

during the year and have not yet reached the age of 70 1/2 by the end of the year.

Contributions may be made up to the lesser of 100% of compensation or $5,000 ($6,000

for individuals over the age of 50) as of 2010. If you maintain multiple IRA accounts,

the maximum contribution to all of the accounts cannot exceed these totals. An IRA

for any year may be opened and funded at anytime before the due date for filing

your tax return, not including any extensions.

Rollover IRA.

If you received an eligible rollover distribution from your IRA, employer's qualified

pension, profit sharing or stock bonus plan, annuity plan, or tax sheltered annuity

plan (403(b) plan), you can roll over all or part of it into an IRA. Rollover contributions

must be made by the 60th day after the day you receive a distribution from your

IRA or employer's plan in order to continue their tax-deferred status. Please contact

us for more information.

Educational Savings Accounts

Eligibility - Any individuals who fall within certain income limits may make contributions

up to $2,000 per year on behalf of a child under the age of 18.

Single tax filers with annual adjusted gross income (AGI) up to $95,000 or married

joint tax filers with AGI up to $190,000 are eligible to make the maximum annual

contribution to a Coverdell ESA.

The amount that may be contributed is gradually reduced to zero at AGI levels between

$95,000 and $110,000 for single filers and between $190,000 and $220,000 for joint

filers.

Tax Deferred Earnings / Tax Free Withdrawals - While contributions are not tax deductible,

the earnings in the account grow on a tax deferred basis and distributions are tax

free if used to pay qualified education expenses.

Please contact us for more information.

Increased Account Protection

As a member of the Securities Investor Protection Corporation (SIPC), funds are

available to meet customer claims up to a ceiling of $500,000, including a maximum

of $250,000 for cash claims. For additional information regarding SIPC coverage,

including a brochure, please contact SIPC at (202) 371-8300 or visit www.sipc.org.

Our clearing firm has purchased an additional insurance policy through a group of

London Underwriters (with Lloyd's of London Syndicates as the Lead Underwriter)

to supplement SIPC protection.

This additional insurance policy becomes available to customers in the event that

SIPC limits are exhausted and provides protection for securities and cash up to

an aggregate of $600 million. This is provided to pay amounts in addition to those

returned in a SIPC liquidation. This additional insurance policy is limited to a

combined return to any customer from a Trustee, SIPC and London Underwriters of

$150 million, including cash of up to $2.15 million.

Similar to SIPC protection, this additional insurance does not protect against a

loss in the market value of securities.